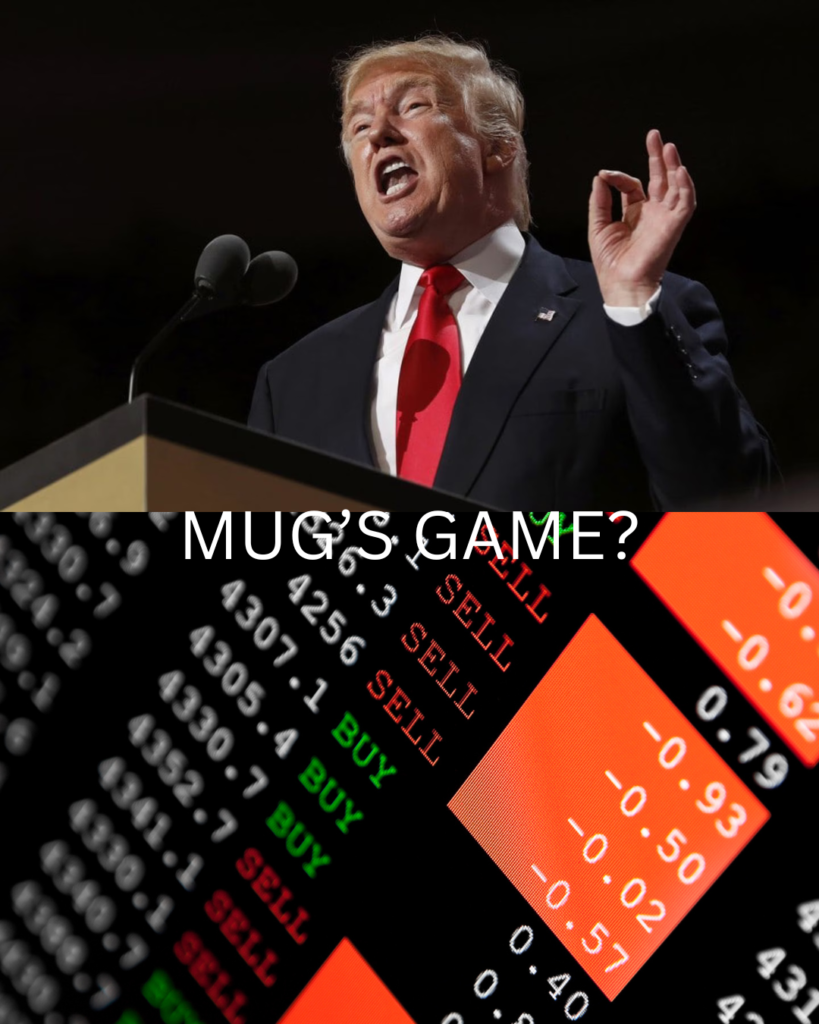

When the late great John Lennon sang, “Nobody told me there’d be days like these,” he could not have foreseen life in 2025 with Donald Trump in the White House playing nasty and cynical games with the wellbeing of humanity and the planet – so don’t waste your money trying to get rich quick on Trump’s tariff lunacy.

By Jacquelene Pearson

It was 1987 when I was first employed as a financial journalist. It was a role I fell into – the first job I was offered out of university, so I took it. On day one I was told to go to the Australian Stock Exchange library in the Sydney CBD and research and write a company profile. I was a small-town girl and google maps didn’t exist, so I asked kind looking strangers for directions to the stock exchange.

I started work shortly after the market crash of 1987 when share trades were still recorded on a live floor onto a big blackboard by men with pieces of chalk. Trades – orders to buy or sell stocks – were shouted out by brokers working phones and the chalkies calculated the share prices in their heads, just like SP bookies at Royal Randwick. The Australian sharemarket was tiny at that stage.

Companies took the enormous step of listing on the Australian Stock Exchange because they needed to raise money to expand, and they didn’t want to do it through debt. They offered shares to the public and thus investors could become shareholders and companies could grow.

Investors acquired shares and usually held on to them as long-term investments based on the underlying value of the company and its ongoing ability to pay regular dividends from its earnings while its share price went up over time.

The traditional share investor, by closely researching the company’s bona fides, just like me that day in the ASX library, could find stocks that would pay regular income via dividends and eventually result in a capital gain because their share price would gradually go up over time. It sounds so quaint and antiquated to describe the market as it was 38 years ago – it is nothing like that today.

A great time to buy – what?

US president Donald Trump’s off-on-off knee-jerking approach to the implementation of tariffs on foreign imports to the US is a form of market manipulation.

It’s easy, from a distance, to write Donald Trump off as an old orange idiot but nothing he does is by chance. He has a playbook – the Art of the Deal – and he does not deviate from it.

Trump’s “maybe I will; maybe I won’t” statements about any of his policies, but particularly tariffs, are calculated to advantage the few at the expense of the many.

These are bullying tactics designed to make the wealthy wealthier and the poor poorer – from the level of national economies down to that of individual garment workers in factories in Thailand.

House Minority Leader Hakeem Jeffries, a New York Democrat, has been quoted widely by US news outlets for stating that the Democrats would be looking closely at “the possible stock manipulation that is unfolding before the American people, including what if any advanced knowledge did members of the House Republican Conference have of Trump’s decision to pause the reckless tariffs that he put into place?”

Hours before Trump reversed his earlier tariff announcement on Wednesday, he took to Truth Social suggesting it would be a great day to buy stocks. If he told certain people about his announcement before he made it, they could have acquired shares and then been greatly advantaged when share prices skyrocketed after Trump’s 90-day tariff cool-off announcement.

Mugs game

Throughout the market gyrations of the past week, TikTok and Insta influencers have been pushing the idea that if you’re young and cashed up right now, you’d be stupid not to buy shares with the intention of making a quick buck from Trump’s indecisive approach to leading the not-so-free world.

Attempting to trade shares in small volumes as an inexperienced individual, in 2025, is akin to a day at the horse races. The “market” as visited by that young journalist in 1987 no longer exists.

In its place is a massive web of artificial intelligence automated trading of synthetic financial derivatives and “products” enabling the biggest institutional ‘investors’ to game the system.

If you’ve got enough money you can trade on futures or other synthetics such as exchange traded funds and contracts for difference using arbitrage to hedge your bets – you can construct your trades – or have the robots do it for you – to win irrespective of whether the market goes up or down. In fact, the big end of town wins whenever the market moves, in any direction.

You won’t read about that in the mainstream financial press. I’m not going to explain the ins and outs of how it works because it’s boring.

But I am going to issue the following strong small investor, young investor, consumer warning.

Super exposed already

If you are of working age in Australia, you are contributing to compulsory superannuation. Unless you’ve chosen a conservative portfolio for your super, which is unusual, you are already heavily exposed to the share market – that’s where “default” super options are mostly invested.

Your superannuation fund is a good place to learn about the sharemarket. Super funds are supposed to provide free general advice and super health checks to their members at least annually.

If you want to learn how to make money out of shares, using your super fund to experiment when you are young makes sense because you have time, decades in the workforce, to rebuild any losses.

Not safe as houses

Moving money out of the bank to “trade” shares in the current volatile conditions is dumb, even if insta influencers want you to believe it’s clever.

Some of the main indicators and “normal” patterns of market behaviours are completely “skewiff” right now – returns from the bond market, for example, would usually improve during periods of share market volatility, but that is not happening.

US government bonds, in particular, are not displaying their usual “safe haven in a bear market” characteristics.

The bottom line is that if you are currently saving for a home deposit, an overseas trip or to pay off your HECS debt early, riding the market rollercoaster with Trump is not a good idea.

Keep your money in the bank. Learn about compounding interest. Make your super fund give you the level of service it is required to. If you want to benefit from the sharemarket, have a long-term outlook.

Even consider learning about shareholder activism, again starting with your superannuation fund and then branching out.