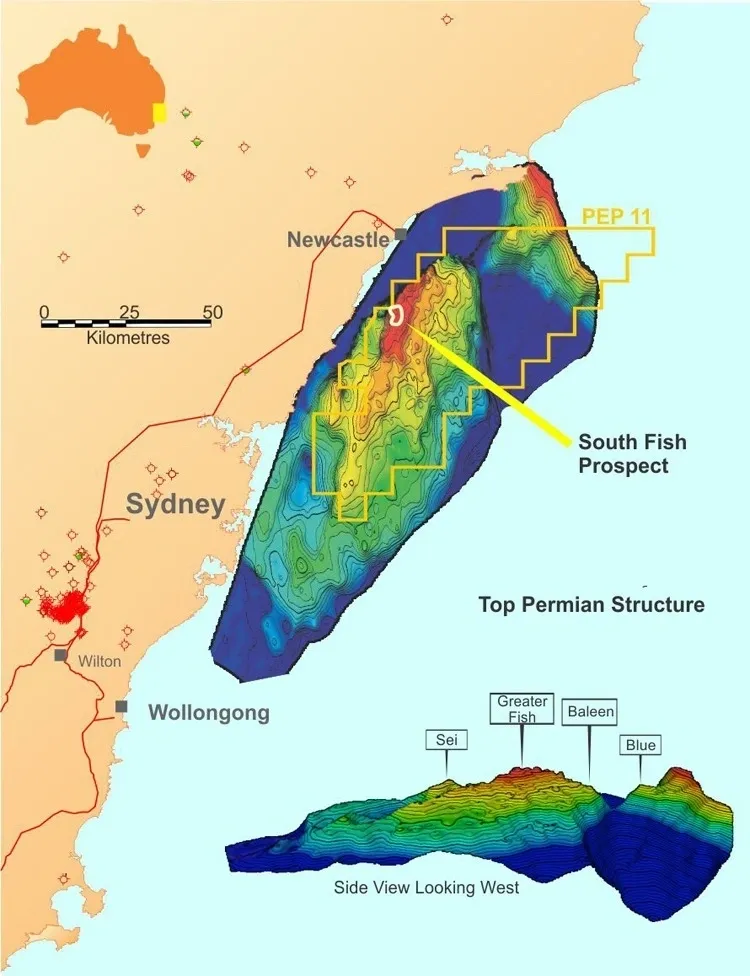

While Central Coast residents cling to the belief that the PEP11 offshore gas drilling license is dead, its proponent continue to talk up the project’s prospects.

Asset Energy Pty Ltd (a wholly owned subsidiary of Advent F,nergy Limited, an investee of BPH Energy Limited) continues to progress the Joint Venture’s applications for the variation and suspension of work program conditions and related extension of PEP-11.

Asset has provided additional information to NOPTA (National Offshore Petroleum Titles Administrator) in response to NOPTA’s recent requests for further information.

While the applications for the variation and suspension of work program conditions and related extension of PEP-11 are being considered, Asset is continuing to investigate the availability of a mobile offshore drilling unit to drill the proposed Seablue-1 well on the Baleen prospect and is in communication with drilling contractors and other operators who have recently contracted rigs for work in the Australian offshore beginning in the first half of 2024.

Further updates will be provided in the BPH Quarterly report to ASX.

PEP-11 continues in force and the Joint Venture is in compliance with the contractual terms of PEP11 with respect to such matters as reporting, payment of rents and the various provisions of the off shore Petroleum and Greenhouse Gas Storage Act 2006.

Asset and its Joint Venture partner Bounty Oil & Gas NL (ASX: BUY) have continued to monitor gas market demand.

The analysis contained in the AEMO (Australian Energy Market Operator) report `Gas Statement of Opportunities” (GSOO) has made a number of key findings.

Despite increased production commitments from the gas industry since the 2022 GS003 gas supply in southern Australia is declining faster than projected demand. As Australia transforms to meet a net zero emissions future, gas will continue to complement Zero emissions and renewable forms of energy, and to provide a reliable and dispatchable form of electricity generation.

The 2023 GSOO highlights continued risks of short-term gas supply shortfalls and long-term gas supply gaps arising from reducing production from southern Australia. In particular. the risk of peak day shortfalls continues to be forecast under very high demand conditions in the southern states from winter 2023.

Enjoy this article? Explore more of our ESG News below:

Environmental Justice News | Social Justice News | Good Governance News | Climate Change News | ESG Investing News | Housing News | Renewable Energy News | Breaking Central Coast News

Prefer your news delivered to your email inbox?

Click here to subscribe to our free weekly newsletter to stay up-to-date with local, national and global ESG news.