Central Coast Administrator, Rik Hart, says the 15 councillors elected in September 2024 will face lower borrowing levels than those elected in 2017, but seven years of audited financial statements tell a different story.

By Jacquelene Pearson

One of the two ‘emergency loans’ negotiated with a Big Four bank in late 2020 has been repaid in full by Central Coast Council. Interim Administrator, Dick Persson, and Acting CEO, Rik Hart, told the public they had to negotiate two emergency loans – for $50 million and $100 million – in late 2020 “to keep the lights on”.

The second emergency loan, for the amount of $100 million, is done and dusted, according to Central Coast Council Administrator, Rik Hart.

“All the principal has been repaid on that in December,” Mr Hart said.

“The first loan Natalia Cowley [former CFO] and I negotiated in 2020 was the $50 million loan which didn’t have the same strings attached to it as the $100 million loan and that is why we have been focused on the $100 million loan.

“We are now putting a regular amount, $1.4 million, aside every month towards the principal repayment over and above the standard principal and interest payments so hopefully the $50 million loan will be paid off by end of this calendar year.”

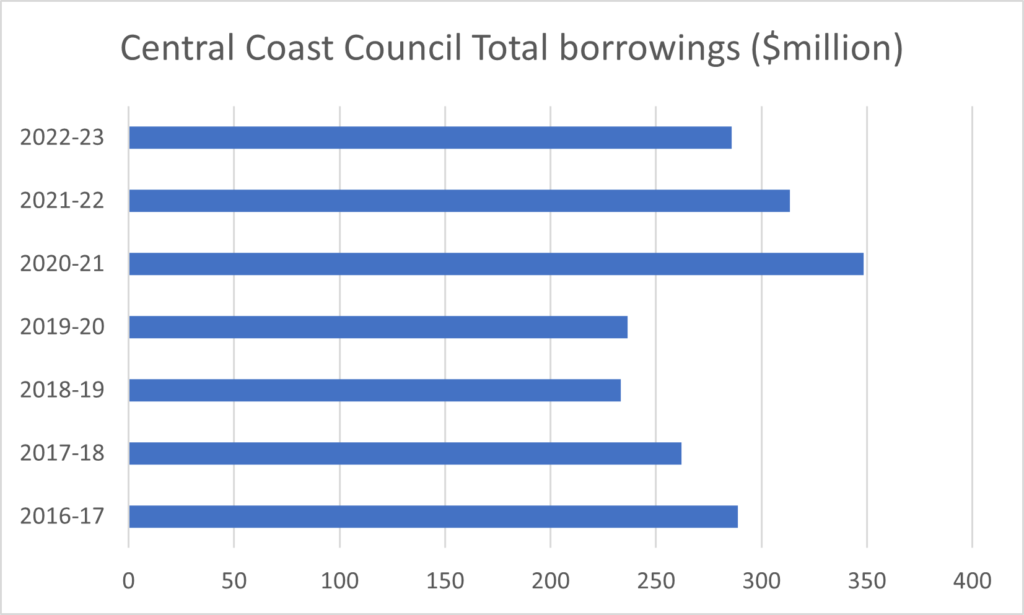

According to Mr Hart, the Central Coast Council’s total outstanding debt in 2020 was $350 million.

The $150 million in additional bank loans negotiated at the end of 2020 were necessary because council’s staff had spent almost $200 million in restricted funds without telling the elected councillors.

As interim CEO and then as Administrator, Mr Hart insisted the spent restricted funds had to be repaid, even though advice from the NSW Solicitor General took a contrary view. In addition to the borrowings, the council, since 2020, has increased rates, made substantial cuts to staff and sold public land.

Mr Hart says that, as a result of these measures, the new councillors will inherit a better set of books than those elected in 2017.

Numbers from annual reports

According to the official financial reports for the 2022-23 financial year, signed off in October 2023 by Administrator Rik Hart, and CEO, David Farmer, Central Coast Council’s total current liabilities were $290.7 million, up from $190.6 million for the 2021-22 financial year and $187.2 million in 2020-21.

Borrowings accounted for $104.2 million of total current liabilities in 2022-23 up from $27.5 million in 2021-22 and $39.5 million in 2020-21.

Looking at non-current liabilities over the same three financial years, borrowings in 2022-23 represented $181.6 million out of total non-current liabilities of $279.8 million. In the 2021-22 financial year those figures were total borrowings of $285.9 million out of total non-current liabilities of $372.9 million. In the 2020-21 financial year, long-term borrowings represented $307.7 million out of total non-current liabilities of almost $400 million.

Hence the overall debt situation the new councillors will face when they take their oath to serve in September-October, will be total borrowings (as at 30 June 2023, depending on any repayments made or new loans negotiated in 2023-24) of $285.9 million out of total liabilities of $8.9 billion.

Current and non-current liabilities, apart from borrowings, include items like contract liabilities, leases and employee provisions.

Now versus then

Now let’s time travel back to the early days of Central Coast Council and have a look at debt levels recorded in the first annual report for the 2016-17 financial year. That was the year that had a couple of additional months – the “financial year” ran from May 2016 (when the Council came into existence) until June 30, 2017.

Then the council was given a couple of extensions by the NSW audit office, so the audited financial statements for that year were not even adopted by council until March 2018.

Total current liabilities were recorded as $153.5 million that year, of which borrowings accounted for almost $24 million.

In terms of non-current liabilities, the total was $340.3 million of which borrowings accounted for $264.9 million.

According to the audited financial reports for the 2016-17 financial year, Central Coast Council had total borrowings of $288.9 million.

The 2017-18 audited accounts show total current borrowings of almost $33 million out of total current liabilities of $195.2 million. Total borrowings under non-current liabilities in the second year following amalgamation were $231.9 million out of $306.9 million total non-current liabilities.

Altogether, for the 2017-18 financial year, Central Coast Council had total borrowings of $262 million.

We’ve looked at the total debt for each year of the Central Coast Council’s almost eight-year history and this is what we’ve found.

According to the annual reports, total borrowings across the seven audited years of Central Coast Council’s existence, were at their lowest in 2018-19 at around $233 million. They hit their highest level in 2020-21 at $348 million.

As the numbers stood at June 30, 2023, Central Coast Council’s borrowing levels have basically gone back to the future, they’ve done a debt pirouette: total borrowings in 2016-17 (over 14 months) was $289 million. If nothing significant happens between now and the September election, total borrowings will be about the same – $286 billion.

One hundred percent better

According to Central Coast Council Administrator, Rik Hart, the councillors elected in September 2024, will have to deal with borrowings “well below” previous levels. It appears Mr Hart is comparing 2022-23 borrowings with the first year of the second period of administration (2020-21).

“Obviously our bank debt was in the order of $350 million, including the $150 million loans and they are largely gone,” Mr Hart said.

He said some of that improvement would be “offset, because we are using debt to fund some of the water and sewer infrastructure, but that was approved by IPART and the principal and interest will be covered by the fees that IPART is allowing us to pay.”

“In terms of when they entered [the first cohort of councillors] in 2017, things will be 100 percent better, because in 2017, when they came in, I don’t believe, under first term of administration or when councillors were elected, I don’t believe the LEPs had been consolidated or any of those things that ought to have been done during that first administration period.

“Financially it will be making surpluses,” Mr Hart said.

He said the emergency loans were intended to be paid off over 10 years but should be totally repaid by the end of 2024, thus avoiding balloon payment penalties.

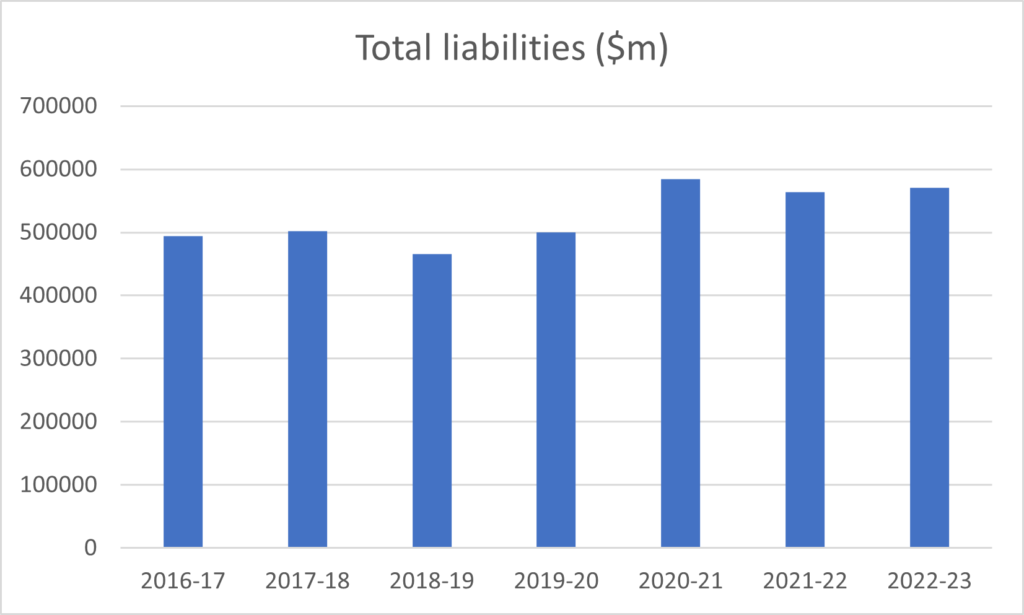

Total liabilities

Borrowings are only one part of the council’s total liabilities and an analysis of total liabilities since 2016-17 shows they were highest in 2020-21 at $584,616 million and have been stuck above $560 million for the past three financial years.

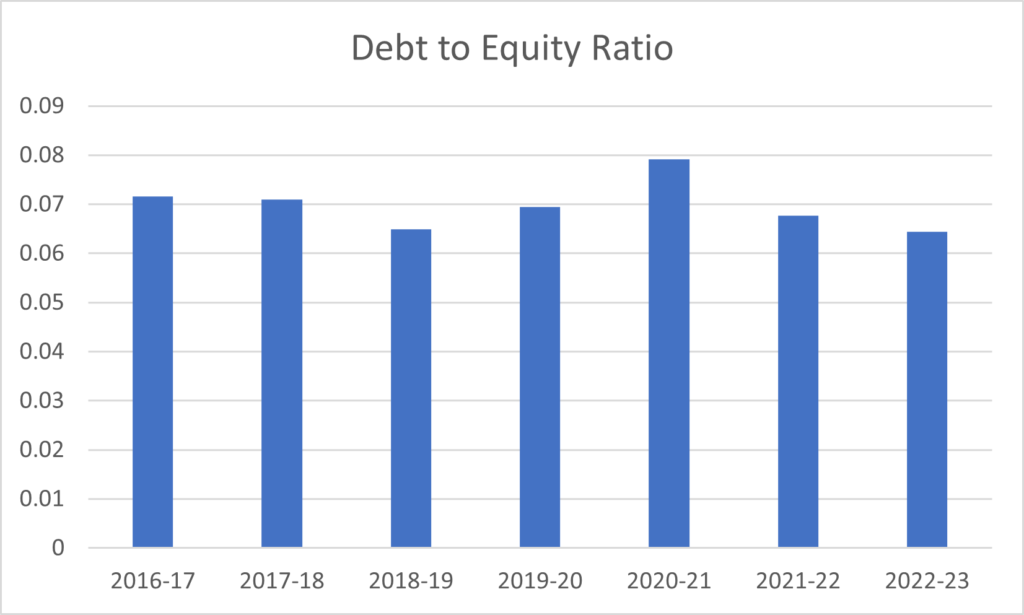

One measure of the performance of major corporations is called their debt-to-equity ratio. It shows the degree to which a company is financing its operations using its own funds as opposed to relying on borrowings.

For the purpose of assessing what sort of improvement there has been in Central Coast Council’s financial performance since its inception in May 2016, we’ve calculated its debt-to-equity ratio for each financial year. The debt-to-equity ratio is calculated by dividing the total debt balance by the total equity balance. If the ratio is 1 or below, the financial health of the company is deemed to be sound. A ratio of 2 or higher is an indicator that the company is carrying too much debt.

If we are to measure the performance of local government on its finances, then Central Coast Council across its eight-year history has sustained a very healthy level of liabilities. It appears the new councillors will be inheriting a very similar set of financial accounts to those who sat in their chairs between 2017 and 2020.

The cashflow crisis that resulted in the suspension and then sacking of those first 15 councillors is not obvious from the annual reports in terms of assets and liabilities. That’s because the staff had been spending restricted funds and not properly reporting that expenditure to the elected representatives.

Meanwhile, the council’s total equity has grown from $6.9 billion in 2016-17 to $8.9 billion and it has grown consistently year on year since the council was created. The greatest gain to total equity occurred during the first two years of the current administration period, largely due to workforce and service cuts and rate increases.