Doing something good for the environment – and for the hip pocket at the same time. Is that really possible?

By Jo Muller*

Due to the mass production of solar panels, investing in a domestic solar PV (photovoltaic) system or in some energy savings measures, can be a positive financial investment. The question is: how good is the investment? And how do you find out?

Often the financial benefit of a solar PV system is described by using the term “payback”.

Payback in this context is just a shortcut for payback time or payback period. It describes how many years it will take until the initial outlay has been paid back or, in technical terms, how long it takes until the break-even point of the investment has been reached.

Some solar installers, consultants and website articles even call this payback time ‘return on investment’ (ROI). This is not accurate. In financial textbooks it can be found that the value for ROI used in finance calculations is shown as a percent value but not a unit of years (https://en.wikipedia.org/wiki/Return_on_investment).

While ‘payback time’ appears to be a simple description of the financial situation, it is problematic because it comes with a number of disadvantages.

Incomparable

The main problem is that using the payback time as an investment guideline results in a disadvantage to the growth of renewable energy. Using the payback time as guidance makes investments in renewable energy or energy saving measures impossible to compare to other financial investments.

This is because payback time is not a term used with other investments. We do not discuss investments by saying, ‘Telstra shares have a payback time of seven years’ or ‘the investment bonds I bought will pay back in four years’.

Misleading It appears obvious what payback time means but it is not that simple, and the interpretation of payback time is prone to mistakes and misconceptions. For instance, one could think that a payback time of say 10 years is a bad thing. But is that really so?

Demotivating

While it sounds nice that putting say $5000 in a 5kW solar PV system and average electricity cost savings of 15 cent/kWh result in a payback time of 5.3 years. But it does not say anything about the additional 20 years where the solar system is producing electricity for free with only some repair and maintenance costs (e.g. replacement of inverter) to be paid. The idea of payback time does not consider the roughly $22,000 earned over this time period.

Incorrect

Payback time does not consider the time value of money.

Having $100 today is not the same as getting $100 in five years. This is because of inflation and because of the interest that the money can generate if we have it today. This is called the time value of money.

To compensate for that, there is a modified version of payback time in use. It is called ‘discounted payback period’ and takes the time value of money into account. However, this approach takes away the simplicity of payback time and requires a calculator app or a spreadsheet to calculate the value.

Use comparison rate instead

Wouldn’t it be better to compare solar PV with any other investment? This is possible and can be done by using what is defined as the ‘comparison rate’.

The comparison rate is a term defined for home loans by the Australian Government. It must be provided with all domestic home loan products.

However, the calculation of the comparison rate can work both ways. In case of investing in energy saving or renewable energy like solar energy, the owner is the ‘bank’ and will receive his ‘payments’ either from savings on grid demand or from an existing feed-in tariff or from a combination of both.

The comparison rate is calculated in the same way as the ‘Internal Rate of Return’ (IRR), which is used in financial mathematics.

IRR is a function that is very difficult to calculate manually. However, it is easy to use on a computer because it is available as a financial function with most spreadsheet programs.

The Internal rate of Return (IRR) can also be explained in simple terms. The comparison rate is the interest rate of a bank account which creates the same income over the lifetime of the project as the solar PV system.

Will I also get my money back? The short answer is yes. If the IRR is positive, the paying back of the initial outlay is included. If for example the IRR is 10%, you will get the equivalent of 10% interest rate AND you will get your money back – not in a lump sum at the end but in a higher annual return than the 10%.

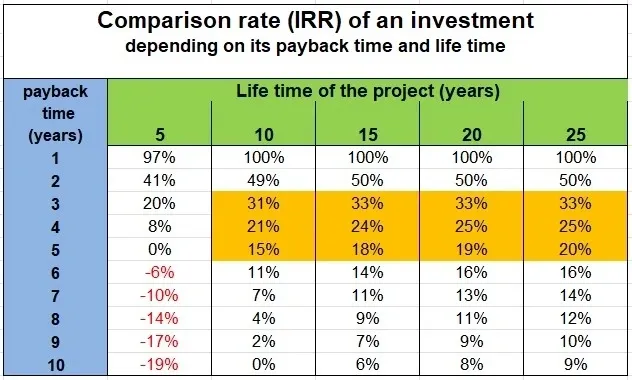

Relationship of Payback time and comparison rate So after all, an investment in solar technology can be assessed like any other financial investment. It is possible to convert between payback time and a comparison rate. The simple table above shows the conversion of the payback time into the comparison rate for a project with a lifetime of 10, 15 and 20 years.

It must be said that the table only assumes an initial outlay and a constant annual income, and it does not take into regard extra expenses like replacing a defective inverter. This will make the real-world data for the comparison rate (IRR) a little bit lower. For a precise calculation it is necessary to set up a detailed spreadsheet or to use a special calculator program. In addition, the income from solar via feed-in tariff (but not the savings) are usually taxable income which will reduce the income to so extend.

The payback time for a solar PV system is usually in the range of three to five years. The comparison rate for that range is highlighted in yellow. As can be seen, an investment in solar can generate very high comparison rates, even over shorter times than the lifetime of solar panels (25 years).

In the initial example a payback time of 10 years was mentioned. This may sound like a pretty poor investment. However, the comparison rate (or IRR) over the lifetime of a solar PV system is still 8.78%.

This means the solar investment with an IRR of 8.8% for a project of 25 years life time is as good as $5000 invested in a savings account over 25 years with an interest rate of 8.8% (and the money back). That’s pretty good! The best savings accounts available today are providing far less than half of this interest rate.

WHAT YOU CAN DO

Using the comparison rate (IRR) to analyse investments in solar PV, and generally in any kind of energy savings, will make these investments fully comparable to any other investment and reveal the full financial potential of these measures.

Using this approach may help you to review the option of installing solar panels on your roof, invest in a new solar or heat pump hot water tank or change your lights to LED lights. You can find out if these measures are not only good for the environment but if they will save you money over the long term.

In a future article we will discuss what is a good solar system to install and what else needs to be considered to make the best out of it.

*Jo Muller migrated from Germany a quarter of a century ago and hugely enjoys the Australian nature. After working for 25 years in industrial research as an IndustrialChemist, Jo decided to retire early and to dedicate his energy to things that are most important to him: sustainability, fighting irreversible climate change and protecting the environment as well as spending as much time as possible with his grandchildren. To help keep the world in a good, or at least acceptable shape for his grandchildren and their peers. Jo is advocating for energy saving and for the use of renewable energy. He is using his scientific background and his spreadsheet skills to calculate the outcome of investing in renewable energy and in energy saving measures in order to demonstrate that we are in the lucky situation that making the world a better place can be done at the same, if not lower cost, than business as usual. He also loves technical things like electronics, computers and building things like, for instance, a new kind of solar cooker.